Prenumerera på vårt nyhetsbrev!

Få nyheter om och analyser av löneutvecklingen för IT-proffs.

Two major trends predicted to have a profound impact on the business world have earned a tremendous and reasonable attention the past few years – Cloud Computing and Fintech. Now they are about to converge which will create a €200 billion worth vacuum within the EU alone.

Among Financial Professionals and Venture Capitalists throughout the world, Fintech is the new darling. In tandem, the migration of traditional client/server models to the Cloud is occupying the entire global business community.

It’s time to start seeing the connections between these two mega trends and realize its true potential as an entity.

For us as individuals, Fintech as well as the Cloud is rapidly adding new and exciting features to our everyday lives. And so much more is yet to come. For multi national businesses, Cloud and Fintech innovations will naturally have a huge impact as well.

No other group, however, will benefit from the convergence of Fintech and the Cloud like the small and midsized businesses (SME). And here is why.

While multi nationals to a large extent already have made extensive efforts to streamline, digitize and automate IT, finance and all other main business processes, the SME businesses rarely have. Small business owners, entrepreneurs and SME managers have in general other priorities. They prefer to spend their energy on developing their offers and on serving their clients rather than on improving processes and structure.

Eastbrook and Finansbarometern (“The Finance Barometer”), have studied how small businesses are dealing with their basic processes such as accounting, banking, payments, e-commerce etc. Even though our study is based on Swedish conditions, the principle is pretty much similar elsewhere.

SME approach to professional e-services today:

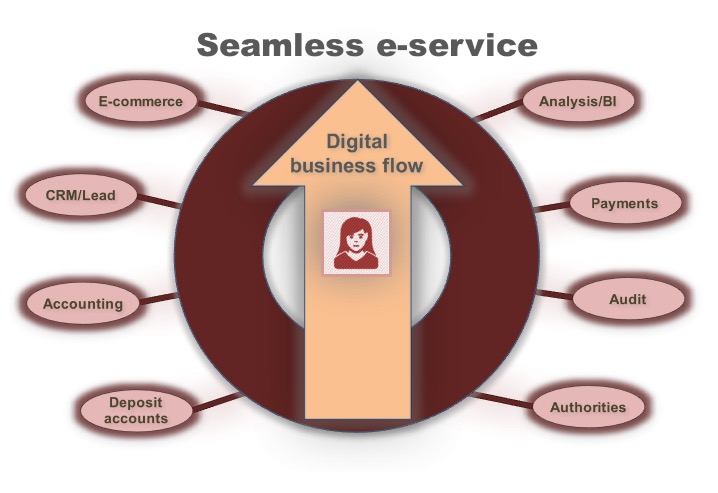

In the future business ecosystem for SME businesses, all professional e-services will be seamlessly integrated into one single service. We can safely assume this since with a few exceptions, the need among small businesses is more or less generic. Also, everything that could be digitized and automated will be digitized and automated.

So what are the implications of this? Well, first of all SME businesses will leverage tremendously on a more efficient chain of professional and financial services. They will cut costs, save precious time that could be spent on creating true value and – last but not least – have more fun when the often times pointless and soul-destroying manual administration is managed by computers.

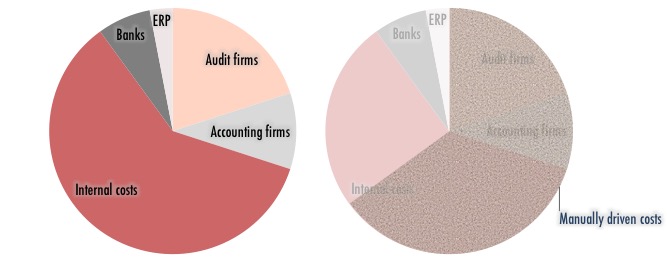

But who else will benefit from this fundamental shift? Today more than half of the costs related to the professional services and financial administration within a small business are internal ones. The rest are mainly distributed between audit and accounting firms, ERP providers and banks.

In addition, approximately two thirds of the SME expenses in this area has its origin in manual activities. Most of these activities will disappear as they will gradually be replaced by algorithms. Once this is done, a tremendous vacuum will occur. Within the European Union alone, the value of this “missing space” equals around €200 billion annually. That is what’s at stake here.

So who will fill this vacuum? Who will provide a seamlessly integrated and highly automated professional e-service? Or to put it in a different way: Who will own the main digital client relation to the SME:s?

Obviously small businesses of the future will not have one single provider of professional and financial e-services solely. But it’s likely that there will be one primary partner (and several secondary) providing the main digital entrance to a seamless e-service. The legacy banks have pole position for claiming this role. But then they have to become something else, otherwise they will probably end up in the back seat.

In order not to be reduced to a utility, a possible and logical strategy for many incumbent banks is to become a platform – Banking as a Platform (BaaS). The idea is basically to have a more transparent and open architecture in order to leverage from innovative external partners that gradually will develop new services.

But in a world of open API:s there are a number of other players that could snitch this desirable position in front of the eyes of legacy banks:

It’s going to be an exciting race and so far the SME market hasn’t really been in the spotlight. But as Fintech and Cloud services are converging, this will change. So who will have the intellectual capacity and leadership skills to quickly adapt to these new circumstances? Who will be bold enough to question legacy truths in order to grasp future potential?

Få nyheter om och analyser av löneutvecklingen för IT-proffs.